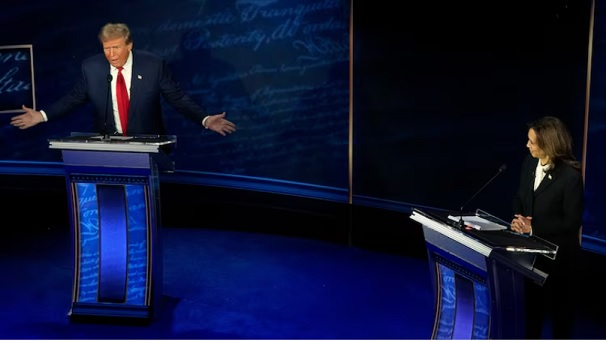

Vice President Kamala Harris and former President Donald Trump met for the first time Tuesday in their first presidential debate of the 2024 election, hosted by ABC News.

The high-stakes, 90-minute debate was held at Philadelphia's National Constitution Center, with Trump and Harris arguing their case for the White House.

As the Democratic and Republican nominees debated the most pressing topics facing the nation, ABC News live fact-checked their statements for answers that were exaggerated, needed more context or were false.

HARRIS CLAIM: 16 Nobel laureates say Trump's plan would increase inflation and land us in a recession

FACT-CHECK: Mostly true

Harris correctly describes what the Nobel laureates said about inflation during Trump's presidency: "There is rightly a worry that Donald Trump will reignite this inflation." But while the group describes Harris' agenda as "vastly superior" to Trump's, their letter doesn't specifically predict a recession by the middle of 2025. Rather, the group wrote: "We believe that a second Trump term would have a negative impact on the U.S.'s economic standing in the world and a destabilizing effect on the U.S.'s domestic economy."

The 16 economists are George Akerlof, Angus Deaton, Claudia Goldin, Oliver Hart, Eric S. Maskin, Daniel L. McFadden, Paul R. Milgrom, Roger B. Myerson, Edmund S. Phelps, Paul M. Romer, Alvin E. Roth, William F. Sharp, Robert J. Shiller, Christopher A. Sims, Joseph Stiglitz and Robert B. Wilson.

HARRIS CLAIM: Trump wants a "20% tax on everyday goods" that would cost families "about $4,000 more a year."

FACT-CHECK: True, but needs context

Trump has proposed a universal "10-20%" tariff on all U.S. imports, from cars and electronics to wine, food products and many other goods. He has also proposed a 60% tariff on imports from China. Vice President Harris called the plan "Trump's sales tax," though the former president has not explicitly proposed such a tax. Independent economists, however, say the proposed import tariffs would unquestionably result in higher prices for American consumers across the board.

The precise financial impact on families is hard to predict and estimates vary widely -- from additional annual costs per household of $1,700 to nearly $4,000, depending on the study. Trump has not called for any tax hikes for American families.

He has proposed exempting Social Security benefits and tips from taxation, as well as extending individual tax cuts enacted in 2017.

TRUMP CLAIM: Trump said, "We have inflation like very few people have ever seen before. Probably the worst in our nation's history."

FACT-CHECK: False, but it was very high

It's true that early in Joe Biden's presidency the annual inflation rate peaked at roughly 9% (June of 2022), but that's not the highest it's ever been. There are several examples of the inflation rate being much higher than 9% in the U.S, including in the immediate aftermath of WWII and during the oil embargo and shortages of the late 70s and early 1980s.

But, there are several examples of the inflation rate being much higher than 9% in the U.S., including in the immediate aftermath of WWII and during the oil embargo of the late 70s and early 1980s when the inflation rate peaked at 14.5 percent. The inflation rate as of July 2024 is at 2.9% annual inflation, the lowest it has been in three years. It should also be noted that President Biden has falsely claimed that he inherited a high rate from his predecessor. In fact, inflation was at 1.4% when he took office.