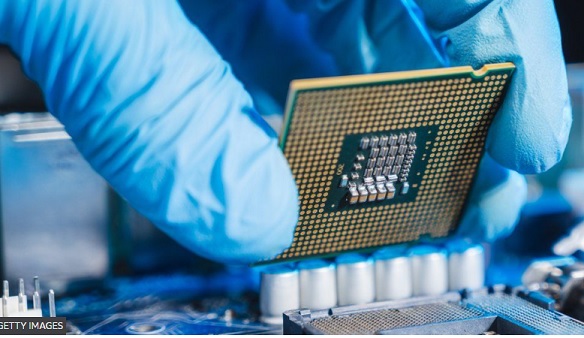

Manufacturers have seen their stocks of semiconductors plunge amid the global chip shortage, the US Department of Commerce has warned.

A survey of more than 150 firms found supplies had fallen from an average of 40 days' worth in 2019 to just five days in late 2021.

Sales of devices soared during the pandemic, leaving semiconductor makers struggling to keep up with demand.

The shortage has resulted in huge disruptions for major industries.

Millions of products - cars, washing machines, smartphones and more - rely on these chips, also known as semiconductors.

"With sky-rocketing demand and full utilisation of existing manufacturing facilities, it's clear the only solution to solve this crisis in the long-term is to rebuild our domestic manufacturing capabilities." the US secretary of commerce Gina Raimondo said in a statement.

The research also found that demand for semiconductors was as much as 17% higher last year than it was in 2019.

Meanwhile, US House Democrats on Tuesday unveiled legislation aimed at increasing US competitiveness with China and spending $52bn (£38.5bn) on semiconductor production and research, after the Senate approved funding in June.

President Joe Biden's administration is pushing to persuade Congress to approve funding to help boost chip production in the US, as shortages of the key components have exacerbated supply chain bottlenecks.

Last week, Intel said it would invest $20bn to build what could be the world's biggest chip-making complex in Ohio.

In November, Samsung announced that it had chosen a site close to the US city of Taylor in Texas for its new $17bn computer chip plant.

The plant is expected to be operational by the second half of 2024. It is the South Korean electronics giant's biggest-ever US investment.